Make Sure Your Business is Protected with a Freelance Contract

There are many benefits to having a freelance contract, both for the freelancer and the client. A contract helps to protect both parties by setting out the expectations and terms of the agreement. This can be especially important in legal and real estate businesses, where accuracy and precision are essential. In addition, a contract can help to establish a clear timeline and budget for a project, ensuring that both parties are on the same page.

Benefits of a Freelance Contract

If you're a small business owner, you may be eager to start working with freelancers. Hiring freelancers can be a great way to get the specialized help you need without committing to a full-time employee. However, it's important to use service agreements or contracts when working with freelancers.

Contracts help to clarify expectations and prevent misunderstandings. They also protect you in the event of a dispute. When drafting a contract, be sure to include key details such as the scope of work, deadlines, payment terms, and your cancellation policy. Having a contract in place can also help to resolve any disagreements that may arise during the project. Overall, a freelance contract is an important tool for ensuring a successful working relationship between freelancer and client.

If you're not sure where to start, there are many templates and resources available online. With a little preparation, you can be ready to start working with freelancers and enjoy all the benefits they have to offer.

Contractor vs Freelancer: What’s the difference?

Freelancers:

When you work as a freelancer, you are self-employed and typically provide services to multiple clients. Freelancers usually work under a service agreement, which outlines the terms of the project, the scope of work, and the compensation. Freelancers are not employees of the companies they work for and are not entitled to the same benefits as employees, such as health insurance or paid time off. However, freelancers have the flexibility to set their own schedules and choose which projects they want to work on.

Contractors:

Independent contractors are also self-employed, but they typically provide services to only one client. Independent contractors usually have more control over their work than freelancers and are often considered experts in their field. Like freelancers, independent contractors are not employees of the companies they work for and are not entitled to benefits such as health insurance or paid time off. Independent contractors also have the flexibility to set their own schedules but may have less control over which projects they work on.

The main difference

Freelancers and contractors are both independent workers who provide services to businesses or individuals. The main difference between these two roles is that freelancers typically work on a per-project basis, while contractors are often hired to work for a set period of time. For example, a business might hire a freelancer to write a blog post, while they might hire a contractor to manage their social media accounts for a month.

When working as a freelancer, you will usually be expected to sign a service agreement that outlines the scope of the project. Once the project is completed, your relationship with the client is typically considered to be finished. As a contractor, on the other hand, you will usually be expected to sign a contract that outlines the terms of your employment This contract can last for any length of time, and you will usually be expected to provide ongoing services for the duration of the contract.

Both freelancers and contractors are responsible for their own taxes and business expenses. However, contractors may be entitled to certain benefits that are not typically available to freelancers, such as vacation pay and health insurance. When choosing between these two roles, it is important to consider your long-term goals and needs.

Freelance Contracts: What you need to know.

When you work as a freelancer, you're usually working on a project basis for a client. This means that you don't have the same long-term relationship with the client that you would if you were an employee. Because of this, it's important to have a contract in place that lays out the terms of your agreement.

A contract can provide protection for both the freelancer and the client. It helps to ensure that both parties understand the scope of the work and the expectations for delivery. It can also help to avoid misunderstandings or disputes down the road. Finally, having a contract in place can give both parties peace of mind knowing that they're protected legally.

If you're doing any kind of freelance work, it's well worth taking the time to put together a contract. It will provide both you and your client with clarity and peace of mind.

A great contract for freelance work will:

1. Manage expectations – once signed, this written agreement spells out exactly what the freelancer and the customer can expect in terms of pricing and quality.

If there are any problems, the contract serves as a reference for both the freelancer and the customer to go to for clarification.

2. Hold both the freelancer and the client to a set of standards – the contract should state how the customer should respond to updates and reviews.

3. Be mutually advantageous — everyone benefits from a freelance contract, which improves the working relationship.

4. Build trust with the client and ensure that freelance services are adequately reimbursed.

5. Save time while looking professional.

What should be included in a freelance contract?

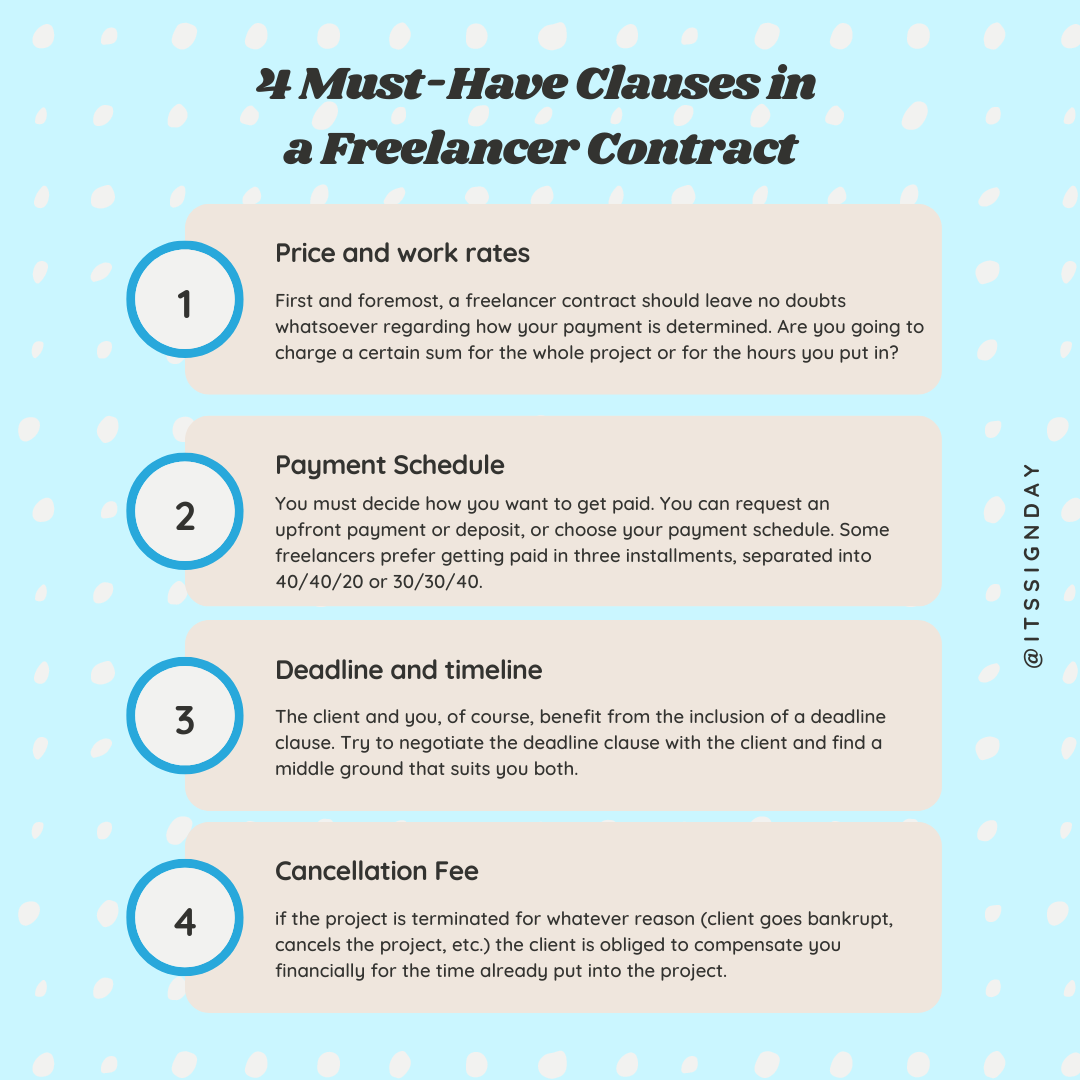

No two businesses are the same, and therefore no two freelance contracts should be alike. However, there are some key clauses that should be included in every contract to protect both the freelancer and the client.

All areas of the employment relationship should be covered by comprehensive freelance terms and conditions. This usually consists of the following items:

1. Contact information for both the freelancer and the client. Both parties' full names, phone numbers, and email addresses are included. The freelancer's EIN or business number, as well as the company's mailing address, are frequently given as well.

2. The purpose of the project: what is the freelancer being hired to do?

3. The length of time it will take: how long will the project take?

4. The number of hours the freelancer is expected to work: how many hours per week or day will the freelancer be working?

5. The compensation: how much will the freelancer be paid? When will they be paid? What forms of payment are acceptable?

6. Intellectual property rights: who will own the rights to the work that is produced?

7. Confidentiality: what information, if any, should the freelancer not share outside of this contract?

8. Termination: under what circumstances can either party terminate the contract?

9. Expenses and equipment: Certain sorts of work may require the acquisition of specific tools, software, equipment, or training by freelancers. In this part, you should specify whether your firm or the freelancer is accountable for the expenditures.

10. Signatures: Last but not least, both parties' signatures are required in order for freelance terms and agreements to be legally binding. To put it another way, the contract is only binding if both parties sign it.

You may want to consider these additional legal documents for freelance work

In addition to the standard Contract, you may also want your freelancers to sign additional legal documents.

Before hiring a freelancer, be sure to discuss which legal documents will be required. This will help ensure that both you and the freelancer are protected and that all of your bases are covered.

1. Non-disclosure agreement: Also known as a confidentiality agreement, this is a legally binding contract that establishes a confidential relationship between your company and the freelancer. It ensures that the freelancer will not disclose any confidential information about your company or project. This can be particularly important if the freelancer works on sensitive or proprietary information.

2. Work for hire agreement: This contract stipulates that your company will own any work the freelancer produces. This can be helpful in ensuring that you retain full rights to any work produced by the freelancer and can be especially important if you plan to use the work in marketing materials or on your website.

3. A non-compete agreement: is a contract in which the worker agrees not to work with other companies that are considered competitors of the hiring company for a specified period of time after the working relationship ends. These agreements also prohibit the worker from revealing proprietary information or company secrets to anyone outside of the organization.

While non-compete agreements can be beneficial for employers, they can also be restricting for workers. It is important to discuss any non-compete clauses with your freelancer before signing any contracts. By doing so, you can ensure that both parties are on the same page and that the freelancer is aware of any restrictions that may be placed on their work.

4. Data protection agreement: If you are working with a freelancer who needs access to sensitive company data this agreement will compel them to comply with your company’s data secrecy and security policies. By having this agreement in place, you can be confident that your data will be protected. Additionally, this agreement will help to protect your company from any legal liability if there is a data breach.